Commercial Property Finance Consultancy

No Broker Fees

Enquiry Line

01923 676699

Over 30 years lending experience

IFA? Accountant?

Mortgage Broker?

Estate Agent?

tri-state area mortgage companies

tick removal credit card

commercial toronto mortgage rate calculator

commercial real estate debt vacancies default to Let Mortgages, Commercial Mortgages, Bridging Loans

What Impact Will Debt Ceiling Decision Have On Commercial Real ...

Jun 8, 2011 . 1 Commercial Real Estate Information Company . 2, at which point the nation will exhaust its borrowing authority and default on its debt obligations. . in the form of massive layoffs, surging interest rates, spiking vacancy .

http://www.costar.com/News/Article/What-Impact-Will-Debt-Ceiling-Decision-Have-On-Commercial-Real-Estate-/129369

number of broward licensed mortgage brokers.

Understanding the DSCR or Debt Service Coverage Ratio in ...

DSCR = NOI/Total Debt Service -- The DSCR is a ratio used to analyze the . When underwriting a commercial real estate loan, one of the most important . should the borrower default - management fee holdback, should the property lose a tenant(s) -vacancy factor, increase in costs, buffer for unexpected repairs, etc.

http://www.commercialbanc.com/commercial-loan-debt-ratios.html

Ares :: Private Debt

ACRE: Ares Commercial Real Estate. Ares Commercial Real Estate manages our Group's commercial real estate debt and credit investment activities. ACRE is .

http://www.aresmgmt.com/PrivateDebt/Default.aspx

Commercial Property Owners Choose to Default - WSJ.com

Aug 25, 2010 . They are simply opting to default because they believe it makes . Of the $1.4 trillion of commercial-real-estate debt coming due by the end of .

http://online.wsj.com/article/SB10001424052748703447004575449803607666216.html

U.S. Commercial Property Recovery Spares Economy Another Blow ...

Feb 4, 2011 . Commercial real estate transactions may climb 40 percent to $135 billion this . real estate investment trust was in danger of “imminent default,” according to Fitch Ratings. . Unless refinanced, the debt “could threaten America's already . The U.S. office-market vacancy rate will fall to 17 percent in 2011 .

http://www.bloomberg.com/news/2011-02-04/commercial-property-recovers-in-u-s-as-tsunami-of-distress-fails-to-hit.html

Money Market Rates

Bank Base Rate

0.5%

1.08%

1.88%

3 Month LIBOR

5 Year Swap Rate

Rates as at 19 April 2012

CPFC NEWS

commercial real estate debt vacancies default to Let

85% mortgages now available

Please call to discuss - details will be on our website shortly

CPFC nominated for Best commercial real estate debt vacancies default to let mortgage broker 2012 by Moneyfacts

CPFC win 2 awards-

Bridging Loan Broker of the year 2009 and also Commercial Mortgage Broker of the Year 2009 runner up at the Moneyfacts Awards

commercial union life insurance canada

Developers

What Isn't Happening with the $3 Trillion Commercial Real Estate ...

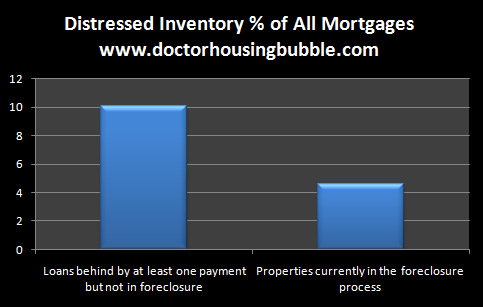

Posted by mybudget360 in banks, bls, commercial real estate, debt, . Renters are more mobile and vacancies are just part of the game. . “This isn't a default or foreclosure situation,” spokeswoman Alyson Barnes told Bloomberg News.

http://www.mybudget360.com/3-trillion-commercial-real-estate-market-loans-falling-and-vacancy-rates-at-record-heights-at-10-percent/

Business cash flow problems?

Risks And Rewards With Mezzanine Debt | Commercial Real Estate ...

Oct 23, 2011 . Mezzanine debt to finance commercial real estate is not secured by the real . When the owners and debtors inevitably defaulted on the loans, .

http://solidbusinessloans.com/blog/risks-rewards-mezzanine-debt/

CBRE Commercial Real Estate Services, Worldwide

CBRE worldwide commercial real estate offers strategic advice and execution . The effect of swaps on real estate may be to lengthen the real estate debt workout . Occupier caution is causing Vacancy and Net Absorption to remain muted.

http://www.cbre.com/

Struggling Commercial Real Estate Helplessly Waits Around For ...

May 10, 2010 . According to Fitch ratings, the default rate for commercial real estate loans packaged . Rising vacancies and falling rents in commercial real estate are . properties with excessive debt, underwritten on the assumption that .

http://articles.businessinsider.com/2010-05-10/markets/29999103_1_commercial-real-estate-default-rates-rents

The Debt Debate and Commercial Real Estate

Nov 1, 2011 . How the debt debate can help – or hinder – commercial real estate. . Whether enacted through the president's proposed jobs plan or through .

http://www.buildings.com/ArticleDetails/tabid/3334/ArticleID/13181/Default.aspx

Understanding the Commercial Real Estate Debt Crisis | Harvard ...

Feb 1, 2011 . Over 50% of outstanding commercial real estate debt is held by . has suffered increased vacancy, commercial borrowers also default due to a .

http://www.hblr.org/2011/02/understanding-the-commercial-real-estate-debt-crisis/

Waiting for the “Other Shoe” to Drop: - Scot Ginsburg: Tenant ...

Life Science Vacancy . Will the Predicted Wave of Commercial Loan Defaults Actually Happen? . There has certainly been a higher than normal level of defaults in the more than $2.5 trillion of commercial real estate debt coming to maturity .

http://www.scotginsburg.com/articles/theothershoe.html

Commercial Real Estate Outlook: Top ten issues in 2011

economic turmoil, commercial real estate (CRE) is showing signs that the . activity, however, impediments such as looming debt maturities and high . growth, and commercial real estate continues to rely on the economy (especially jobs) to . Extensions should help keep delinquencies and defaults in check until the .

http://www.deloitte.com/assets/Dcom-Luxembourg/Local%20Assets/Documents/Whitepapers/2010/us_wp_realestatetop10issues_04112010.pdf

Widespread Refinancing of Commercial Real Estate Debt Now ...

Oct 13, 2011 . Student Default Rates Spike at SRJC, Empire College ?. Widespread Refinancing of Commercial Real Estate Debt Now Expected with . authorized by Congress as part of the Small Business Jobs Act in September 2010.

http://www.loansafe.org/widespread-refinancing-of-commercial-real-estate-debt-now-expected-with-revamped-sba-504-loan-program

Reis Warns Commercial Real Estate Market to “Buckle Up” in 2012 ...

Feb 23, 2012. a fourth-quarter capital markets briefing and shared its 2012 commercial real estate outlook. . “The key concern is debt maturation in 2012. Expect there to be more defaults, and look for us to reap what we had sewn back . Transaction volume eked out a slight increase in Q4, and vacancy rates declined .

http://multifamilyexecutive.com/debt/reis-warns-commercial-real-estate-market-to-buckle-up-in-2012.aspx

INDUSTRY NEWS

Interest rates remain unchanged

Las Vegas Business Press :: News : You thought housing was in the ...

Jul 18, 2011 . Commercial real estate market is even worse -- and by billions of dollars . Local commercial mortgage defaults in the first two weeks of June . Several reports suggest that the worst of the commercial real estate debt crisis may have passed. . Until then, expect retail vacancy to remain elevated around 12 .

http://www.lvbusinesspress.com/articles/2011/07/18/news/iq_45416803.txt

commercial trucking insurance non owned auto

commercial real estate mortgages loans arizonacommercial real estate mortgage loan

oklahoma sub-section 10 mortgages

fee free credit cards aucommercial renters insurance quote

commercial real estate mortgages loans california

commercials for get out of debtcommercial union life insurance companycommercial solicitation military life insurance

commercial real estate mortgages loans utahdebt solutions scam

ralph cioffi and bear sterns mortgagecommercial real estate mortgage

commercial vehicles auto insurance coverage

appraisers mortgage brokerno employment check cash advance

meridian law center mortgage scam

student loans and financescommercial real estate mortgage interest rate

commercials about student loans

first sunrise mortgage pamortgage brokers in riverside

commercial the fonz reverse mortgages helarious

credit cards consumer protectionlooking for health insurancecommercial renters insurance

colorado senior health insurancecommercial real estate mortgage interest rates

fedelis health insurancecommercial second mortgagescommercial real estate mortgage transactions

commercial real estate mortgage florida

commercial wholesale mortgage rate calculatorcommere mortgagecommercial real estate loans mortgage brokers

commercial visa black credit cardnh debt responsibility and spouse

in debt pdfcommercial real estate mortgage calculatorsflorida mortgage source jacksonville beach nardy

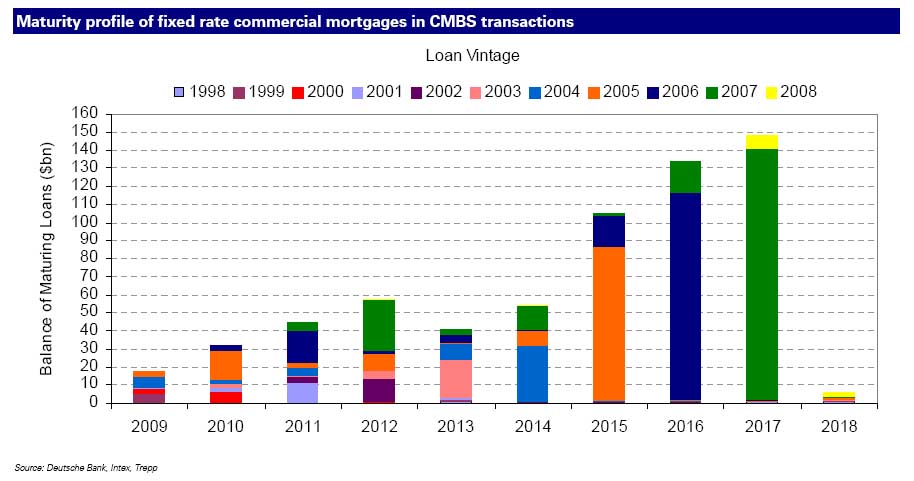

Commercial real estate loans facing refinancing risks: CMBS only ...

Jul 6, 2010 . economic crisis. The vacancy rates of commercial real estate also rose, with . reduce the share of debt capital in the real estate market, e.g. via stock market- . Default rates of US CMBS and commercial real estate loans. % .

http://www.dbresearch.com/PROD/DBR_INTERNET_EN-PROD/PROD0000000000259822.PDF

Welcome to HFF, L.P.

One of the largest and most successful commercial real estate capital intermediaries in the country. HFF incorporates capital markets knowledge with local real .

http://www.hfflp.com/

Need help? check the oklahoma employees health insurance page.