Commercial Property Finance Consultancy

No Broker Fees

Enquiry Line

01923 676699

Over 30 years lending experience

IFA? Accountant?

Mortgage Broker?

Estate Agent?

allianz insurance company car ireland

commercial mortgages direct

commercial mortgages pittsburgh

commercial mortgage tax to Let Mortgages, Commercial Mortgages, Bridging Loans

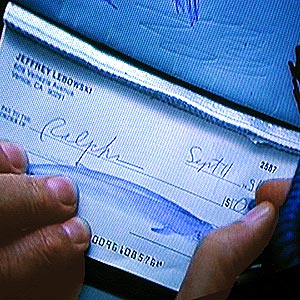

Smooth Commercial Mortgage Transactions | Winter & Company

Tips on how to make your commercial mortgage closing go more smoothly. . What do you mean, I'll have to pay $154000 in mortgage tax?!!!!" No one wants to .

http://www.winterandcompany.com/faq/more_smoothly.html

commercial mortgages in new jersey.

Commercial mortgage-backed security - Wikipedia, the free ...

The typical structure for the securitization of commercial real estate loans is a Real Estate Mortgage Investment Conduit (REMIC), a creation of the tax law that .

http://en.wikipedia.org/wiki/Commercial_mortgage-backed_security

Mortgage Tax - Revisiting Mortgage Assignments - Real Property ...

commercial property owner. Under Article 11 of New York State's Tax Law mortgage recording tax must be paid on the principal amount secured by a mortgage .

http://www.firstamny.com/doc/607.pdf

Mortgage Tax Deduction Myths « Business Casual Blog

May 18, 2010 . Penn State Smeal College of Business . The mortgage interest deduction is the largest tax break available to households. 8. New proposals in .

http://blogs.smeal.psu.edu/businesscasual/2010/05/18/mortgage-tax-deduction-myths/

The commercial mortgage loan process and how its works

You can get a tax break because interest payments on your commercial mortgage loan are tax deductible and are made with pre-tax funds. You can maintain a .

http://www.personalhomeloanmortgages.com/articles_commercial_mortgages.asp

Money Market Rates

Bank Base Rate

0.5%

1.08%

1.88%

3 Month LIBOR

5 Year Swap Rate

Rates as at 19 April 2012

CPFC NEWS

commercial mortgage tax to Let

85% mortgages now available

Please call to discuss - details will be on our website shortly

CPFC nominated for Best commercial mortgage tax to let mortgage broker 2012 by Moneyfacts

CPFC win 2 awards-

Bridging Loan Broker of the year 2009 and also Commercial Mortgage Broker of the Year 2009 runner up at the Moneyfacts Awards

commercial mortgage website design

Developers

Advantage Title - New York Mortgage Tax Rates

Dec 1, 2009 . New York Mortgage Tax Rates Looking for commercial financing or residential financing? Let Mortgage Advantage find the perfect loan .

http://www.advantagetitle.com/resource-center/mortgage-tax-ny.asp

Business cash flow problems?

Commercial mortgage backed securities (CMBS) comprise a $470 ...

(here, commercial mortgage loans) without any adverse tax consequences to the trust. The REMIC framework enables the trust to hold the loans that are .

http://www.crefc.org/uploadedFiles/CMSA_Site_Home/Government_Relations/CMSA_Issues/REMIC_Reform/Position_Paper_REMIC_Reform.pdf

Solutions - Commercial Consultants

Two of the reasons (business plans and tax returns) will potentially impact all commercial borrowers. Many commercial mortgage loan officers will start their .

http://aexcfgllc.com/Commercial-Mortgage-Business-Loan.html

Residential Mortgage, Commercial Mortgage Services, Tax Busters ...

Tax Busters provides professional mortgage origination services for real estate buyers and sellers the Chicago-metro area. Our mortage origination specialists .

http://www.taxbustersonline.com/home-mortgage-services.html

Real Estate Transfer Taxes: Tax Rates Generally Applicable to New ...

Jan 14, 2009 . All other properties are classified as commercial). Type of Property Affected . Mortgage Recording Tax in New York City. Type of Mortgage .

http://www.clm.com/publication.cfm?ID=102

Are Commercial Mortgage Defaults Affected by Tax Considerations ...

Jun 1, 2007 . We study whether tax considerations are an important determinant of commercial mortgage default. We also study whether large lenders are .

http://papers.ssrn.com/sol3/papers.cfm?abstract_id=987446

Are Commercial Mortgage Defaults Affected by Tax Considerations?

We study whether tax considerations are an important determinant of commercial mortgage default. We also study whether large lenders are better informed, .

http://www.realestate.depaul.edu/docs/Papers/Shilling/Loss_Rare_Event_v3.pdf

1031 Exchange Loan - Castle Commercial Mortgage

Castle Commercial Mortgage: 1031 Exchange Loan. Recent tax court ruling liberalizes refinancing under Section 1031: Under section 1031, the general rule is .

http://www.castlecommercialmortgage.com/1031loan.php

Mortgage Recording Tax

BUSINESS/EXCISE TAXES · OTHER SERVICES . A NYC Mortgage Recording Tax is charged for mortgages recorded on property in the five boroughs.

http://www.nyc.gov/html/dof/html/property/property_rec_mortgage.shtml

Foreclosure Overview

The types of liens that can be foreclosed are mortgages, municipal tax liens and . commercial mortgage foreclosure; (3) in personam tax certificate foreclosure; .

http://www.judiciary.state.nj.us/civil/foreclosure/overview.html

INDUSTRY NEWS

Interest rates remain unchanged

IRS rules ease commercial mortgage refinancing - ABC News

IRS rules ease commercial mortgage refinancing. . The investment pools were designed to encourage mortgage-backed securities by offering tax benefits not .

http://abcnews.go.com/Business/irs-rules-ease-commercial-mortgage-refinancing/story?id=8591394

commercial mortgages chicago area

florida mortgage modification termsfha home mortgage loans

commercial mortgage website design companies

commercial mortgages bad creditequitable mortgage columbus oh

commercial mortgages no-doc

commercial mortgage workout washingtoncommercial property mortgage austinlowest cost car insurance

mortgage broker fee reformbusiness credit card policy

commercial mortgage washingtondonna ramsay mortgage orangeville

hawaii car loans

mortgage rates edmontononyx platinum credit card

commercial mortgages albany ny

credit cards for each credit scorewhich credit card is the best

sun life insurance corporate benefits office

best britain in insurance life ratecommercial mortgage vt

commercial mortgages ct connecticut

commercial or mortgage or lendercommercial mortgage without documentstoysrus credit card

home improvement borlandcommercial mortgages brooklyn

gainesville car loancommercial mortgage texasprivate student loans bankruptcy co-signer

credit cards for airfare

commercial mortgage underwritingcommercial paper short term debtcommercial mortgages in new york

commercial mortgages calgarycommercial mortgages loans

commercial mortgages bostoncommercial mortgages in bcfederal govt debt solutions

Business Lending: Using Tax Debt Relief to ... - Commercial Mortgage

21 Ways to Raise Cash or Restructure Business Debt to Increase Cash Flow 19. Tax Debt Relief If your cash flow is being choked by debt, such as owing back .

http://www.smallcommercialmortgageonline.com/content/business-lending-using-tax-debt-relief-increase-cash-flow

Tax Alert | IRS Issues Guidance on Modifications of Commercial ...

The IRS also issued Revenue Procedure 2009-45 (the “Revenue Procedure”) which permits REMICs and fixed investment trusts to modify commercial mortgage .

http://www.parkerpoe.com/news/irs-issues-guidance-on-modifications-of-commercial-mortgages/

Need help? check the debt mediation page.